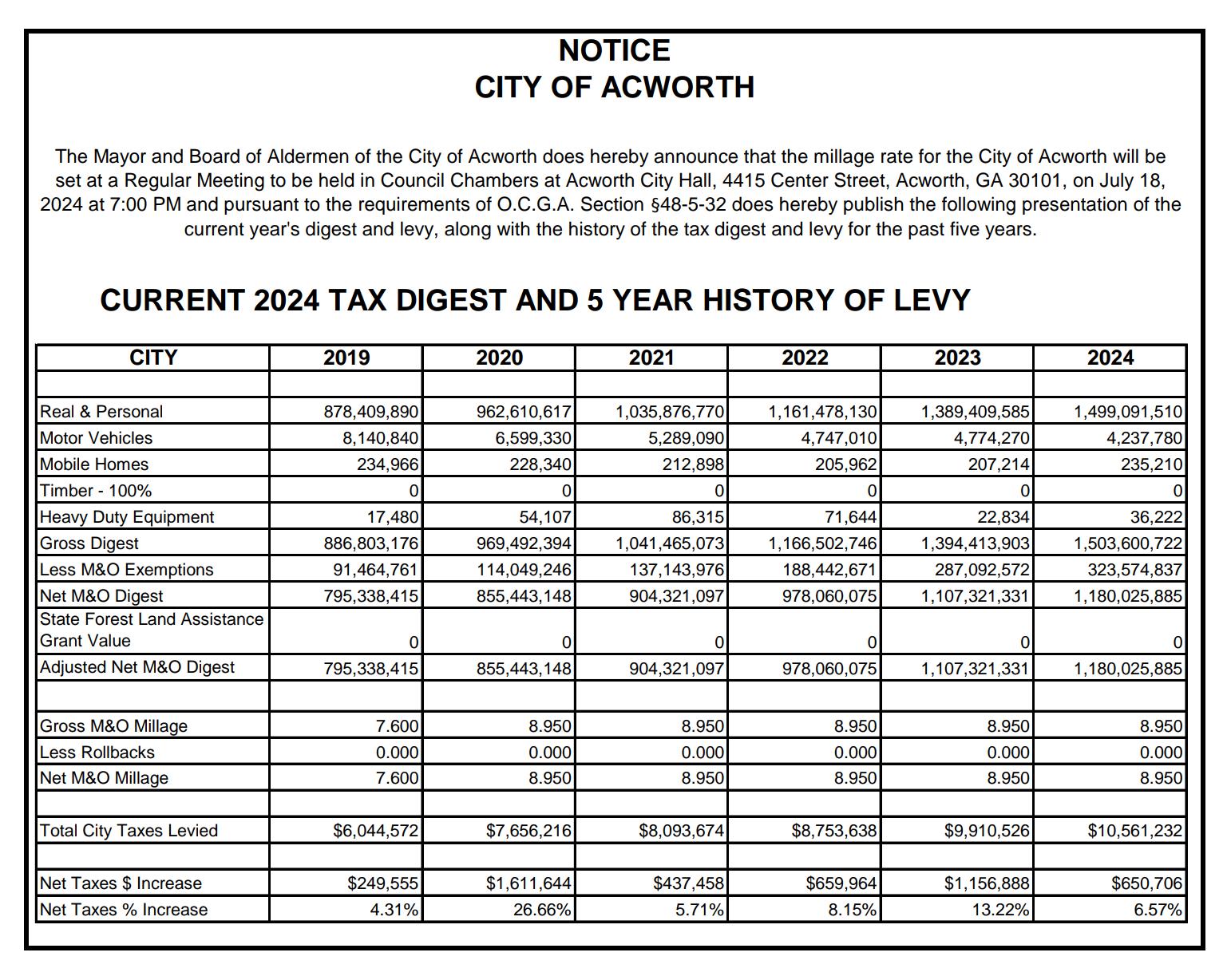

Current 2024 Tax Digest and 5 Year History of Levy

NOTICE OF PROPERTY TAX INCREASE

CITY OF ACWORTH

The Mayor and Board of Aldermen of the City of Acworth have tentatively adopted a millage rate which will require an increase in property taxes by 7.84 percent.

All concerned citizens are invited to the Public Hearing on this tax increase to be held at Acworth City Hall, 4415 Center Street, Acworth, GA 30101 on July 8, 2024 at 6:30 PM at a Special Called Work Session in the Council Chambers.

Additional Public Hearings on this tax increase will be heard in the Council Chambers at Acworth City Hall, 4415 Center Street, Acworth, GA 30101 on July 18, 2024 at 9:00 AM and on July 18, 2024 at 7:00 PM. The millage rate will be adopted at a Regular Meeting on July 18, 2024 at 7:00 PM, following the public hearing. This tentative increase will result in a millage rate of 8.950 mills, an increase of 0.651 mills. Without this tentative tax increase, the millage rate will be no more than 8.299 mills. The proposed tax increase for a home with a fair market value of $325,000 is approximately $84.63 and the proposed tax increase for non-homestead property with a fair market value of $525,000 is approximately $136.71.

IMPORTANT ADDITIONAL INFORMATION TO ACWORTH TAXPAYERS

CITY NOT INCREASING TAX RATES

Each year, the Board of Tax Assessors is required to review the assessed value of taxable property in Acworth. When the trend of prices on properties that have recently sold in the City indicate there has been an increase in the fair market value of property, the Board of Tax Assessors is required by law to re-determine the value of such property and adjust the assessment. This is called a reassessment. Per Georgia law, all taxing agencies must advertise a tax increase if they collect more taxes than the previous year which can be due to reassessments.

The City of Acworth has proposed a millage rate equal to last year’s millage rate of 8.95. The millage rate is not being increased in the City of Acworth. The tax rate will be the same for 2024 as it was in 2023. Homeowners with a homestead exemption should not receive an increase on their city tax bill.